Corporate Governance

Policy/view

Since our company was founded with the corporate motto of “Sincerity, Willingness, and Technology,” and with the founding philosophy of “Winning customers’ trust by conducting good work,” we have adopted a basic management philosophy of providing quality that gives a sense of reliability, security, and satisfaction to our customers and the local community, under the principle of quality and customer first. Further, in order to contribute meaningfully to society at all times through our business, we have established a “MAEDA Corporate Conduct Charter” and a “MAEDA Conduct Standard,” and as a member of INFRONEER Holdings, seek to achieve open management through which we can gain the understanding and empathy of our various stakeholders.

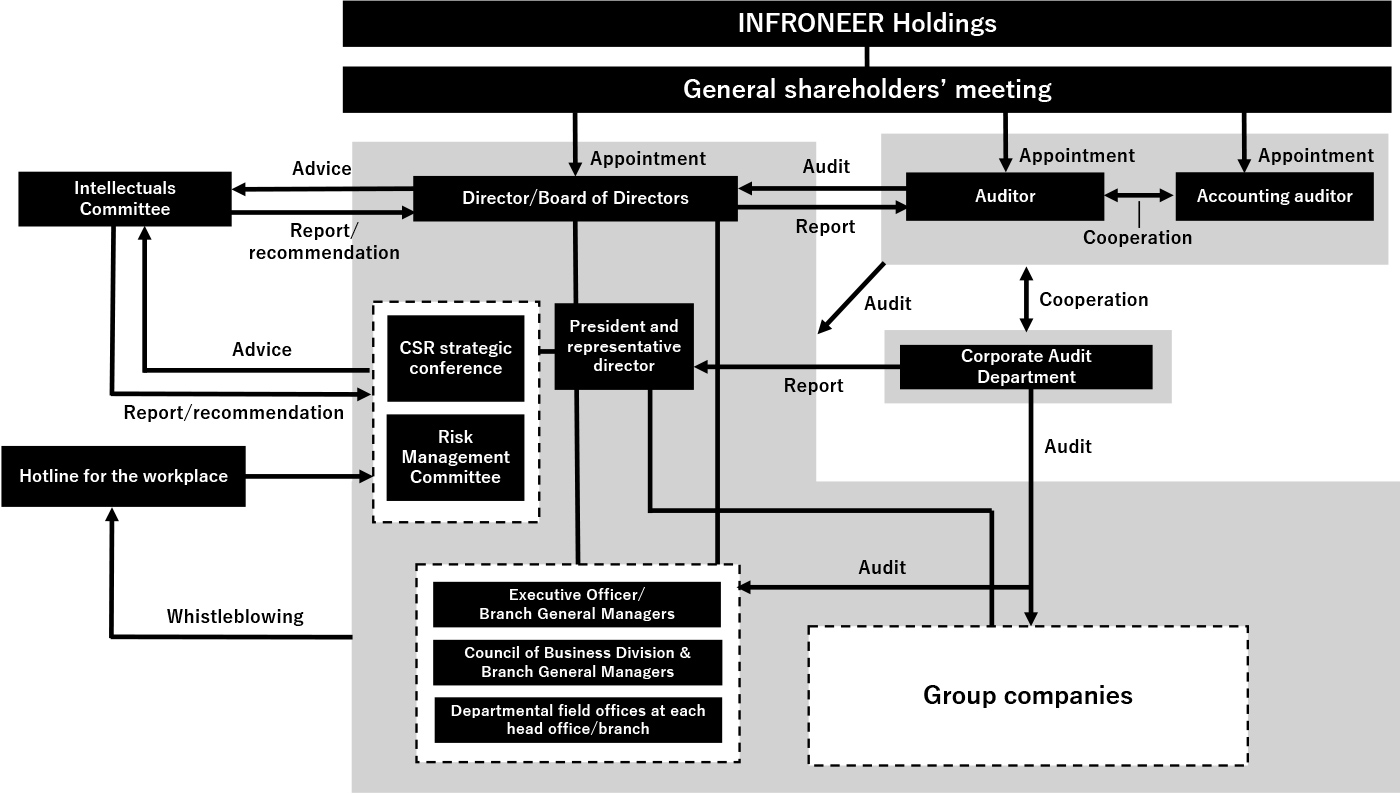

Our fundamental idea of corporate governance is as follows. To ensure our corporate management, we recognize that it is essential to enhance the internal control function in order to continually increase the corporate value of not only the INFRONEER Holdings Group and the MAEDA CORPORATION Group, but also the entire INFRONEER Holdings. In cooperation with INFRONEER Holdings, we implement measures such as establishing and improving our management system while aiming at improving the efficiency, integrity, and transparency of our management.

Structure and Roles of the Board of Directors

Our company has arranged our management system to improve the efficiency, integrity, and transparency of business activities' accountability and management. We have established a risk management system and arranged an internal control system other than the adoption of an auditor system, the one-year system of the director's term of office, the appointment of external directors/non-executive directors (3 persons out of 7 persons in total), and the appointment of external auditors (one person) (as of June 2023). The Board of Directors ensures persons with extensive experience and broad knowledge in various circles and the well-balanced structure have been maintained by keeping the ratio of external directors in the entire board of directors at more than a third. Also, apart from the Board of Directors, an executive officer system and the Council of Business Division & Branch General Managers have been established, which seek to accelerate management decision making and clarify business execution responsibilities.

Furthermore, in September 2006, we set up an “Expert Committee,” which consists of external experts, with the aim of making recommendations/reports on the framework that our company should uphold as a public institution of society, concerning compliance and CSR in general, from the viewpoint of governance.

As a member of INFRONEER Holdings, we intend to establish an effective governance structure while aiming to be a company that is trusted by all stakeholders.

State of Audit

- (i) State of auditor’s audit

- To sophisticate the group governance structure as a member of INFRONEER Holdings, which adopts the form of a company with a nominating committee etc., our company has shifted from a company with a board of auditors to a company with auditors. At present, we have appointed one full-time outside auditor who has many years of experience in practical business and operation on national tax affairs and has an appreciable extent of insight in finance and accounting.

Each auditor attends the Board of Directors and expresses his/her opinions if required. In addition, opinion exchange meetings with the president and periodical opinion exchange meetings with external directors are held. The full-time auditor attends the Council of Business Division & Branch General Managers once a quarter where the business execution is reported, communicates with directors, etc., collects information, and views documents on important requests for approval, etc. As for the field operating audit of the head office, branch offices, and subsidiaries, based on the audit policy and audit plan for each fiscal year, the full-time auditor reports the audit results at the meeting of the Board of Auditors, and the report is made available for inspection by the executives concerned.

- (ii) State of internal audit

- The Corporate Audit Department directly controlled by the president is in charge of our company’s internal audit. An internal audit plan is formulated for each fiscal year, and audits based on the risk assessment from a stakeholder’s perspective are conducted at each department of the head office, branch offices, subsidiaries, and others. The audit results are reported to the president and a full-time auditor, and recommendations etc. are made to related departments as required.

Concerning matters such as the mutual cooperation of the internal audit, auditor’s audit, and accounting audit, the Board of Auditors holds an accounting audit liaison meeting, an internal audit liaison meeting, and a joint liaison meeting to seek mutual cooperation by inextricably exchanging information such as the audit policy, audit plan, and audit results by the Corporate Audit Department and the accounting auditor, and makes recommendations based on the audit results or the like to the internal control department as necessary.

- (iii) State of accounting audit

-

- a. Name of the audit corporation

Ernst & Young ShinNihon LLC - b. Continuous audit period

61 years - c. Certified public accountants who executed the task

Satoshi Suzuki

Takehiro Ametani - d. Composition of the assistants involved in the audit operations

Five certified public accountants and 19 other persons are involved in the accounting audit operations.

- a. Name of the audit corporation

Executive compensation, etc.

The compensation etc. of directors is determined, through a resolution of the Board of Directors as needed, in light of a deliberation by and report from the Compensation Committee of INFRONEER Holdings within the scope of the limit resolved at the general shareholders’ meeting. In addition, we adopt a compensation system that is connected to our business performance so that it fully functions as an incentive to continuously improve our corporate value, and have a basic policy under which the compensation for each director shall be determined at an appropriate level in light of their duties and responsibilities.

The compensation for executive officers consists of the following as the outline of the policy for determination:

- a. Basic compensation of a fixed amount paid every month

- b. Bonus paid once a year

- c. Performance-related share-based compensation

- d. Share-based compensation with restriction on transfer

For external directors, the basic compensation is only paid from the perspective of independence.

![Business performance of directors: [KPI] Percentage of attendance at the meeting of the Board of Directors](/assets/images/english/csr/governance/cg/cg_img02.jpg)